April 2013 Meeting pre-agenda

-

Roll Call

-

Open in Prayer

-

Mission Statement and Core Values

-

Approve March meeting minutes (please review prior to meeting)

-

Signature items

-

Board signature graphic

-

Bank – for Jeff and Niki to become signers I need new copies of current signer’s IDs so the bank knows it is you that signed the form. All signing members & officers please bring a copy of your ID to the meeting.

-

-

Voting items:

-

Vote on Tax Preparation Vendor

-

Discuss Wilson and Wilson doing FYA’s taxes. Due to Brad’s conflict of interest here he will leave the room for the discussion. Basically, a colleague of his at the office has agreed to do the return, and we will pay for that.

-

-

Approve Board Evaluations (A few slight text changes were made to this, please read and be ready to vote and accept these at the meeting – included at the end of this text.)

-

Approve Financial Policies

-

Patrick and Marylee worked over a basic financial policy just so we had something at least temporary in place. I think the board should review this (see below) and be ready to vote for acceptance at the meeting, just so we have something solid and in place. It can be further revised later. Our board approved policies will then be posted to the board website under policies so we know where we are in the development of these time consuming documents – it is a work in progress.

-

- Vice President position in light of Danny Bramer’s resignation

- Is anyone willing to take on this position?

- We also need someone to head up the fundraising committee.

-

-

Art Auction advertising for the May 5 Event:

-

Meyrem, who is organizing this event will only be at the meeting for a short while. We can discuss ways to market this event to the community.

-

-

Director’s board report, Q/A time

-

Clinical Director’s report

-

Q/A time (Dave Bates will be joining us to discuss the issues related to the possible house purchase and other questions we may have about CC)

-

-

New building acquisition and report

-

Report from Dave Miller on recent visit and evaluation of the property adjacent to the Door.

-

- Review Strategic Operating Plan and Operating Goals

-

Summertime volunteer appreciation picnic

-

Sarah F. will update on this event.

-

-

Thank you personal phone calls:

-

Patrick thinks that Marylee should make the initial call to large donors, so they connect with her and know her voice. After that, one of the board members can call with a follow-up thank you and perhaps an update on the Door? Who would volunteer to make a call to those listed below?

-

Jean and Bob Tsigonis, they made a $7500 contribution (Dec. 2012)

-

ABR made a $3500 donation (Dec. 2012)

-

-

-

Calendar 2013 review

-

May 5 NHS Art Auction event

-

Other fundraisers

-

May 10 – 6:00 p.m. 4-k Graze – Walk for Charity? (Last year we made ~$250 by just telling a few people) we have a huge facebook following & 60 volunteers. Should we do this?

-

Credit Union 1 May 23,

-

One Homeless Night, Sept. ?

-

Fat Bet ??

-

November Homeless Youth Awareness Month?

-

-

Outreach:

-

Clucking Blossom, May 11

-

In From The Cold, January 2014

-

-

Future board meetings.

-

Please log on to the board website and update the calendar for any known travel dates.

-

May 9 for next board meeting?

-

Date for June (Patrick gone from June 1-27 – VP to head up a meeting in his absence in June?)

-

-

-

Policies

-

Protocol for shelter policies and employee policies, etc.

-

How does the board want to approve these because we have about 100 of them we are about to send the state and they need to go ASAP. Because it is time sensitive, Marylee would like to send these on now. In the meantime, what do you all think about getting a committee of a few people to review these and present any necessary information to the board at the next meeting? And make changes as necessary.

-

-

-

Discuss donor scheme and plans: please bring your brainstorming ideas to the meeting on this, as we will settle on something in order to further define the donor page on the website

-

REPORTS

-

The Door, Building Report: Dave to add any further updates at the meeting

-

From Margarita at the Brorough: Pat (engineer) is in the final stages of completing the RFP. He is waiting for the results of a soil sample that will be included in the RFP. We will submit a copy for your review. The RFP will only be out to bid for 21 – 30 days.

-

-

Public Information Report:

-

Plans for a photo shoot to replace the header rotating images on the home page of the website.

-

Once we finalize on a donor scale, the donations page will get revised

- Statistics on Social Media: Twitter, Facebook, Googles Stats

-

I hope everyone read the last newsletter, it was an impressive one, and a marked reference to some major progress that FYA has made over the past year.

-

-

Fund Raising Report: Danny to any further updates at the meeting

-

Friends Church has not yet informed us of the amount from the art fundraiser.

-

-

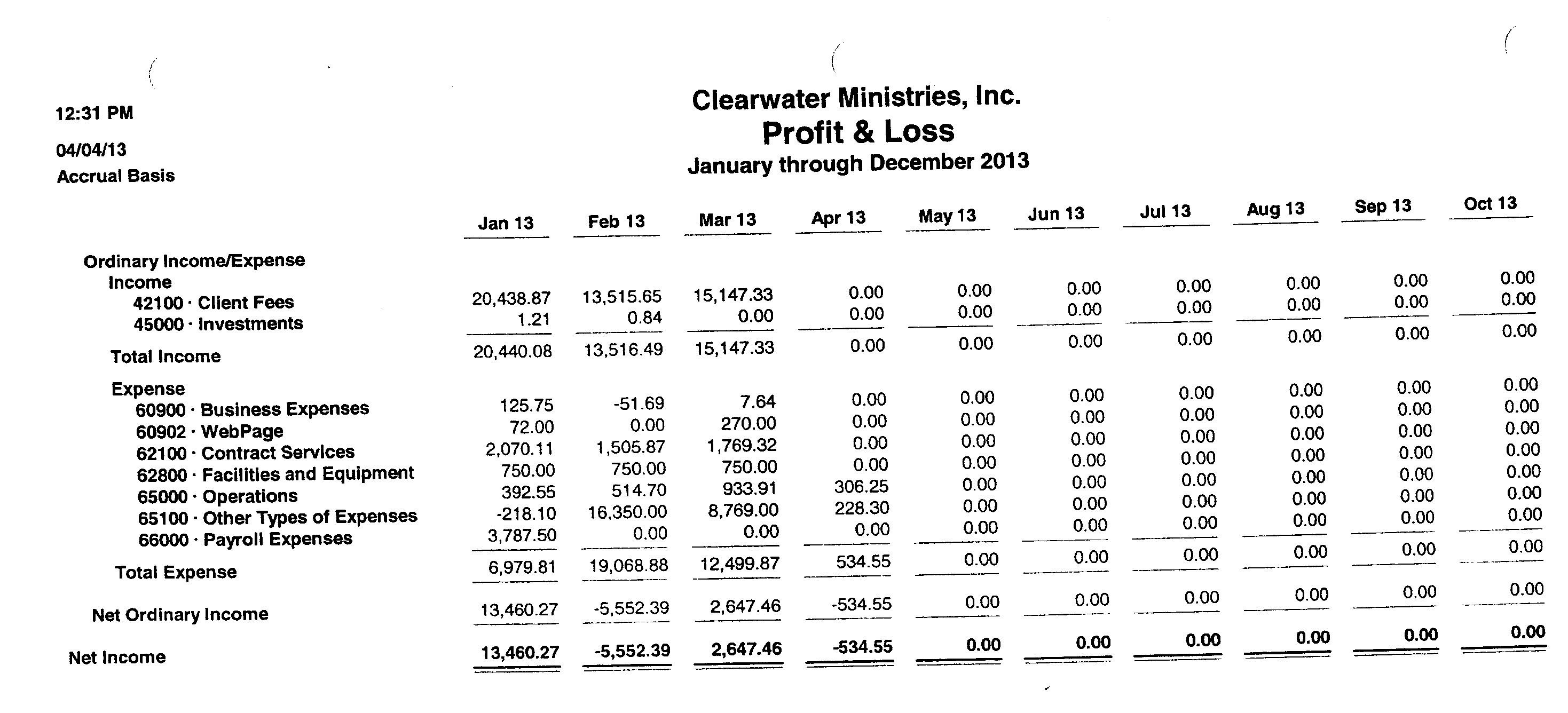

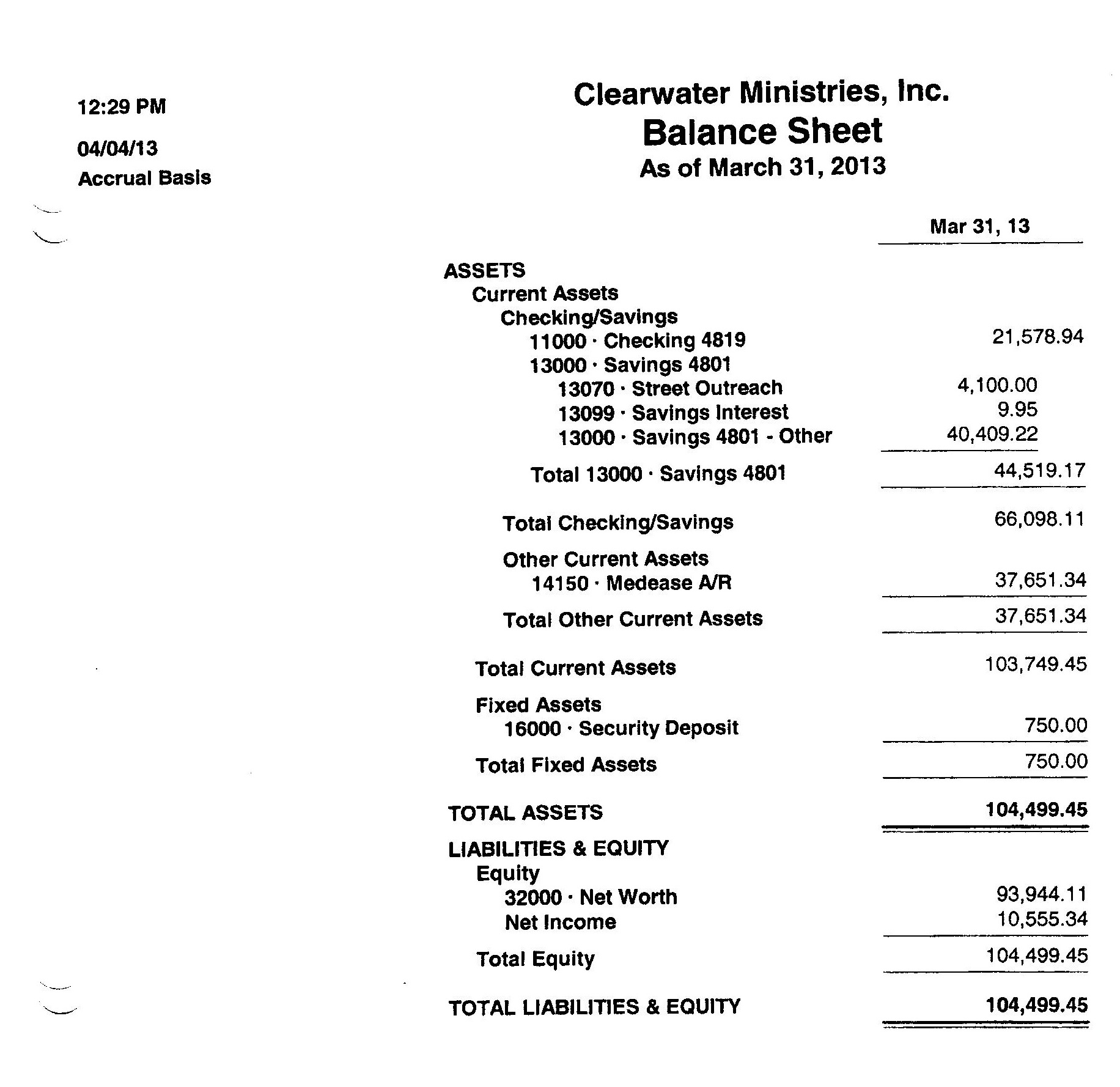

Financial Report: Brad to add any further updates at the meeting

-

See blog post on treasurer’s report.

-

FYA credit card: (M thinks we may have voted on this)

-

Would a board member volunteer to do this. I know they need some financial information and Brad could supply that upon request. I tried a while back but we were rejected. https://business.bankofamerica.com/USBCapp/Ctl/entry?sc=UABO6T&pid=dasb&mktg_track=EOLB&track=000000ECOMM#b

-

-

-

*******************************************************

(this is the latest and final doc for evaluations) we will vote to accept it and it will be posted on the board website)

FYA BOARD EVALUATIONS

Board Evaluation (ratings = 1/low-disagree – 5/high-agree)

Board Mission and Purpose

-

Board meeting presentations and discussions are in alignment with and consistently reference the organization’s mission statement.

1 2 3 4 5 -

The board has a strong commitment to the agency’s Christian mission.

1 2 3 4 5

Board Membership

-

The board has good attendance and members come to meetings prepared to participate. A quorum is reached on a regular basis.

1 2 3 4 5 -

The board has a range of talents, experience, and knowledge to accomplish its role, and uses them effectively.

1 2 3 4 5 -

The board make up is diverse in experience, skills, ethnicity, gender, denomination and age.

1 2 3 4 5 -

All board members, old and new understand their roles and responsibilities.

1 2 3 4 5

Board Organization

-

Information provided by the executive director and is adequate to ensure effective board governance and decision-making.

1 2 3 4 5 -

The committee structure logically addresses the organization’s needs and operations.

1 2 3 4 5

-

The committees address issues of substance, and provide the board with meeting summaries.

1 2 3 4 5

Board Activities/Meetings

-

The board spends its time on the issues that matter most to the agency’s success.

1 2 3 4 5 -

The board works together as a team.

1 2 3 4 5 -

The board encourages differing points of view and is able to constructively disagree.

1 2 3 4 5 -

The board routinely educates itself about the work of the agency and issues it will face in the future.

1 2 3 4 5 -

The board receives regular financial updates and takes necessary steps to ensure the operations of the organization are sound.

1 2 3 4 5 -

Board members receive meeting agendas and supporting materials in time for adequate advance review.

1 2 3 4 5 -

The board understands and is supportive of the strategic planning process of the ministry.

1 2 3 4 5

Board Governance/Partnerships

-

The board agrees on how to judge the agency’s success and regularly measures its effectiveness.

1 2 3 4 5 -

The board annually reviews its partnering organizations, donors and affiliates.

1 2 3 4 5

Administration/Staff Support

-

The board has a good relationship and communicates well with the Executive Director and provides annual evaluation and coaching.

1 2 3 4 5 -

The board has a good relationship and communicates well with the Clinical Director and provides annual evaluation.

1 2 3 4 5

Comments

Board Member:

-

How do you assess your contribution to this ministry? (You might want to include such things as: attendance at board meetings, donations, participation, promotion and fund-raising, prayer, committee work, or any other areas on which you would like to comment)

- Have you reviewed the Board Member Expectations and is your involvement with the Board in accord with them.

-

How would you like our ministry to nurture your development as a board member?

-

As a board member,what changes would you suggest in the operation and involvement of the board?

-

Are you interested in serving beyond your initial commitment?

*********************************************

(Colored text may need special attention) believe it or not, this is a short version. please read and bring any comments or changes with you to the meeting. It needs to get finalized and posted for our licensing.

Fairbanks Youth Advocates

Financial Policies and Procedures

GENERAL

Fairbanks Youth Advocates (referred to from here on as FYA) is a 501(c)(3) organization governed by a board of directors. FYA receives funding from the profits of Clearwater Counseling (CC) (a subsidiary of FYA), grants from governmental organizations, and donations from individuals, organizations, and businesses.

RESPONSIBILITIES

Board of Directors Responsibilities

-

Establish the financial and accounting policies and procedures.

-

Adopt an annual operating budget.

-

Authorize expenditures not included in the annual budget.

-

Authorize transactions that may impact the financial position of FYA, this includes but is not limited to the borrowing of funds, acceptance of grants and/or donations with restrictions.

-

Ensure payroll and other taxes are paid in a timely manner.

Board President

Assure the integrity of the board’s process and occasionally represent the board to outside parties. Conduct an annual evaluation of the Executive Director and communicate the goals and objectives for the Executive Director during the upcoming year as approved by the board of directors or executive committee of the board.

Board Secretary

The secretary is the officer responsible for signing all official documents on behalf of the board of directors.

Board Treasurer

Review the financial records to include reconciled bank statements, grant reports, and other required financial reports. Monthly reviews are recommended but required at least quarterly. The Treasurer is also responsible for providing a summary of the current financial status of FYA to the board of directors at regular board meetings. The summary will include, as a minimum, the current balance sheet and profit & loss reports from the accounting program. An analysis of future cash flows may also be presented as needed.

Executive Director

The Executive Director (ED) is responsible for the day to day activities of FYA and is the official spokesperson and face of FYA. The ED will ensure the policies and procedures established by the board of directors are followed and is responsible for operating within the financial parameters established by the board of directors in the annual operating budget. The ED is responsible for the efficient and effective use of FYA funds and for controlling costs so as not to exceed the operation budget. Prior board approval is required for expenditures that exceed $1000 over and beyond the budgeted line item. Board approval is also required for any expenditure not contained in the operating budget. The ED will not make any financial commitments not previously authorized by the board.

FINANCIAL AND ACCOUNTING

FYA and its subsidiary Clearwater Counseling maintain separate checking accounts and a use QuickBooks for recording financial transactions. FYA financial activity is consolidated with CC for tax reporting purposes. All accounting transactions will be recorded in FYA’s QuickBooks ledger. All transactions will be assigned to the appropriate account and class (fund). Use of the memo field is encouraged to assist other users to understand the transaction. All transactions require supporting documentation that is filed within the accounting office (see FILES section below).

Journal Entries

Journal entries should be used sparingly when another QuickBooks function will not work. The reason for the journal entry will be stated clearly in the memo field of the entry. All journal entries are to be printed and filed with supporting documentation.

Fund Accounting

All grants and other restricted funds receipts and expenditures will be accounted for in QuickBooks using a separate class (fund). All unrestricted funds will be accounted for in the general operating class (fund) unless specified by this policy for reporting purposes. Expenditures are required to be reported as Program, Management & General, and Fundraising for tax return and financial reporting in accordance with Generally Accepted Accounting Principles. The check requests and time cards should allocate the documented expenditure to one or more programs, general operations, and/or fundraising. Specific fundraising events may be accounted for as a separate class within the fundraising group. An allocation of indirect costs (utilities, general supplies, rent, etc.) may be made to the various programs, to include grants as allowed by the granting agency, and fundraising. These allocations will be made based on a rational methodology appropriately documented, such as percent of building used by the activity, hours of employees spent on the activity, or another acceptable basis.

Investments

Authorized investments are limited to demand deposits (checking or savings accounts) at institutions covered by FDIC, NCUA or similar insurance.

Internal Controls

FYA shall maintain a system of internal administrative and accounting controls necessary for:

-

Safeguarding assets against waste, loss, unauthorized use, and misappropriation;

-

Promote accuracy and reliability in accounting and operating data;

-

Encourage compliance with FYA policy; and

-

Evaluate the efficiency of financial operations in all areas of FYA.

Donations

For the purposes of this policy, the term “Cash” includes coin, currency, checks, money orders, credit card payments, or electronic bank transactions. FYA can receive either cash or noncash donations. Non-cash (in-kind) donations are accepted on a case-by-case basis after considering the need for the item(s) and other factors that may be applicable. FYA has the right to decline any donation.

Restricted Donations

Donations may be restricted by purpose or by time and can be temporarily restricted or permanently restricted. Any donation received with restrictions must be reviewed by the board prior to acceptance. Restricted donations will be segregated from unrestricted funds in the accounting records and until the restrictions are met or no longer applicable.

Donated Securities

As a general policy, donated securities (stocks, bonds, mutual funds, exchange traded funds, etc.) will be sold when received, following review and decision by the board of directors.

Online Donations

-

Donors get an email notification and thank you via email, stating their donation amount and our tax ID. This serves as a receipt for tax purposes. The “donation response” is saved as a canned response in Google email.

-

Donors are recorded in a spreadsheet noting their contribution method, amount & address. The same information is entered into QuickBooks upon recording the donation.

-

Contributions are transferred individually from the online donation source, (currently GreaterGiving and PayPal) to Alaska USA electronically.

Check and Cash donations

-

Donors are logged in a spreadsheet noting their contribution method and amount by the ED. The same information is entered into QuickBooks upon recording the donation. (decision: re: double recording. Patrick is in favor of Quickbooks being installed on a primary workstation computer at the FYA office, and a book keeper enters information there as a primary source as opposed to duplicate entry)

-

Photo copy is made of the check and or cash.

-

Cash and check donations should be deposited into FYA’s Alaska USA checking account as soon as possible after receipt. (M’s doing this 1x a week)

-

Deposit slip is attached to photocopy of checks and or cash.

Consideration of using online deposits via iphone -

Copies stored in Donor files at FYA office (temporarily using Clearwater Counseling office until the shelter is running). (M is only storing USPS letters from donors, etc. and filing copies of deposit slips – but no longer making multiple copies of everything. Is this ok?)

-

Contributions/deposits entered into QuickBooks as they come in or on a monthly basis.

-

Thank you note acknowledging the donation should be sent to the donor at the time of donation.

All cash donations are recorded by ED in 2 Google Docs titled Donations (current year) and Accounts Payable – weekly. Board Treasurer transfers information into Quick Books at his convenience. (See above note about duplicate entry)

Noncash (In Kind) donations

-

Donors and details of the donation are recorded in a Google Doc called Donations (current year). The same information is entered into QuickBooks upon recording the donation.

-

Donations of expendables (office supplies, etc.) are recorded as both in-kind revenue and expense. (WE ARE NOT RECORDING THESE AT THIS TIME BUT WE COULD _seems like we need another spread sheet or file?) Is this a QB item or a google doc item?

-

Donations of capital goods or for the construction of capital assets (appliances, building materials, etc.) are recorded as in-kind revenue and as an asset.

-

-

Thank you note sent to donor and should include a description of the property donated.

-

Except as noted below, FYA is not in a position to establish the value of any non-cash donation. For tax purposes, it is the donor’s responsibility to determine and support the value of the donation.

-

When non-cash donations are received with a current receipt/bill of sale (i.e. the donor purchased the item and then donated it to FYA), the value on the receipt/bill of sale may be included. A copy of the donor’s receipt/bill of sale will be filed in the Donors file at Clearwater Counseling office.

-

IRS Issues & Requirements

-

FYA is required to provide a written receipt to the donor for any contributions of $250 or more received in a single day in order for the donor to be able to claim a deduction. The receipt must contain the name and address of FYA, date of the contribution, and whether any goods or services were provided to the donor in return for the contribution and the fair market value of the goods and services provided to the donor.

-

The value of cash donations received

-

For non-cash donations a description of the property donated and the location of the donation. See above regarding reporting the value of the donation on the receipt.

-

-

Donations of cars, boats, & airplanes to FYA that the donor values over $500 will require FYA to provided the donor with Form 1098-C, Contributions of Motor Vehicles, Boats, & Airplanes, within 30 days of the receipt of the donation.

-

FYA may be asked to complete and sign part IV of Form 8283, Noncash Charitable Donations, for noncash donations of $5,000 or more. This is an acknowledgement that, if FYA sells the donated property within 3 years of the date of the donation, FYA will file Form 8282, Donee Information Return, with the IRS and provide a copy to the donor.

Other Income

Unless specified by FYA board of directors, donors of restricted donations, or grantors, all interest or other income earned on deposits or investments is unrestricted.

Disbursements

All expenditures are authorized by the board of directors through the adoption of an annual operating budget. Prior board approval is required for expenditures exceeding $1000 of a budget line item.

Two signatures are required on all checks written for $1,000 or more (should this also be for items that the board has already approved and knows will exceed $1000, like insurance for example? We want to be efficient with policy, not create more work for our hard working ED and others). Payments may not be split in order to circumvent this policy. Officers, excluding the treasurer, and selected other board members who have signed the bank’s corporate signature card may be signers on the checking account. The Executive Director is also a signer on the account.

Accounts Payable

-

All bills will be entered into QuickBooks on receipt using the date of the invoice not the date the bill is entered. Make sure the due date generated by QuickBooks matches the due date on the bill.

-

Bill payment checks will be processed weekly and mailed within a reasonable period after printing. Bills should be paid by their due date to prevent FYA being charged late fees.

-

Do not hold checks pending availability of cash in the checking account. If sufficient funds are not available, do not prepare or print the bill payment check.

-

The tax ID number (social security number or employer identification number) for all individual vendors (to include casual laborers) is required to be on file.

-

These vendors must be set up in QuickBooks as eligible to receive a Form 1099

-

No payments to these vendors should be made until their tax ID number has been provided.

-

Check Writing Procedures

-

No blank or incomplete (missing payee or amount) checks will be signed or issued.

-

Hand written checks will be used until computer generated checks and procedures are in place. After that time handwritten checks are permitted by exception only.

-

Checks are prepared only from the appropriate supporting documentation (vendor invoice, employee time card, receipts, check request, or other supporting documentation). (I have been writing FYA checks directly to vendors that we are purchasing supplies for i.e. copy paper – how does that fit in here?)

-

The supporting documentation must accompany the check when presented to the authorized check signers for signature.

-

The check signers should initial and date the supporting documentation as evidence that the supporting documentation was presented with the check for signature.

-

Payroll Procedures

-

Pay periods will be the 1-15, and the 16 through the end of each month.

-

Electronic time cards are due the first workday following the end of the pay period.

-

The electronic time card must be submitted by the employee as a PDF to their supervisor. Supervisors approve by sending them onto the ED. The ED forwards them to the Payroll preparer.

-

Payroll is prepared from time card information.

-

Staff sign time cards in person when they pick up their paychecks.

-

Paychecks are to be distributed no later than five (5) working days following the end of the pay period.

-

Federal payroll taxes are required to be paid by EFTPS within 3 days of the paycheck date. Payroll taxes should be paid the same day as the paychecks are prepared to avoid missing a due date and incurring penalties and interest.

-

Prepare and submit quarterly payroll tax reports (Form 941, Employer’s Quarterly Federal Tax Return & Alaska Quarterly Contribution Report) no later than the end of the month following the end of the quarter.

Leave Processing

Leave is calculated in QuickBooks payroll and is printed on the pay check stub. Leave accrual is printed on the pay stub and employees are responsible to ensure the balance is correct.

* design a form for employees to submit a request – for trading worked holiday hours and earned hours instead of no pay.

Payroll Record Retention

A permanent employee file will be maintained on all employees and include as a minimum:

-

Form I-9, Employment Eligibility Verification;

-

Current W-4;

-

Employment agreement or other document establishing position, pay rate, and benefits;

-

Documentation of changes in position, pay rate, or benefits; and

-

Other payroll related documents such as payroll deductions or garnishments.

Travel Expenditures

Prior to the commencement of travel for FYA business, employees must receive the authorization of the Executive Director. The Executive Director should when possible notify the board of directors of any upcoming travel for FYA. Each employee traveling on FYA business will file a travel report with the Executive Director within three working days upon returning. The travel report shall consist of dates, means of travel, arrival and departure times (and can consist of boarding passes and electronic schedules). The Executive Director will provide a trip report to the board of directors for any official travel by the Executive Director. Reimbursable travel expenses consist of:

-

Air travel and rental car (if deemed necessary at destination) expenses. Premium fares (first or business class airfare or luxury rentals) will not be reimbursed.

-

If a privately owned vehicle is used, the traveler is authorized reimbursement for mileage driven on FYA business at the federal standard business mileage rate.

-

A daily per diem allowance based on State or Federal Guidelines for the location of the travel is authorized for the costs of hotel, food, and incidentals. (this is extreme – and M has not been able to conclude my own travel to Anchorage because of this. Federal per diem is 86 a day, state was 64 or something – yet I would be making money if I did that. Personally I would prefer a flat rate of $50 for meals per day and other expenses be reimbursed item by item?? There is an option to do either per deim or actual expenses. The latter is more accurate, but more paperwork. Depends how much travel is going on…

Bank Reconciliation Procedures

A bank reconciliation shall be performed on a monthly basis for all FYA bank accounts to ensure all activity recorded by the bank is recorded in QuickBooks. The bank reconciliation should be performed within one week of receiving the bank statement.

-

If there are checks over 90 days old that have not cleared, consider asking the payee about the check. Document the response in the vendor/employee file.

-

Investigate all deposits that have not cleared. If you suspect that a deposit is in transit at the date of the bank statement, call or access account on-line and note the actual deposit date on the reconciliation.

-

The bank reconciliation report from QuickBooks along with the bank statement will be presented to _____________ and as requested to members of the board of directors for review. Those reviewing the bank reconciliation should initial and date the reconciliation as evidence of their review. (If we stay on this track, the reconciliation statements can be brought to each board meeting and signed by the vice president, and if necessary, presented to the board)

-

Should we say something about the Clearwater Counseling accounts also being presented to the board on a monthly basis??? (I suppose so)

Reporting Requirements

-

Quarterly payroll tax reports (Form 941, Employer’s Quarterly Federal Tax Return & Alaska Quarterly Contribution Report) are prepared after the end of each calendar quarter and must be filed no later than the last day of the month following the quarter.

-

Forms W-2 and 1099 are required to be prepared after the end of the calendar year and provided to the recipients no later than January 31 of the following year.

-

Forms W-2 and the accompanying W-3 must be filed with the Internal Revenue Service no later than February 28. (I don’t know about this BRAD??)

-

Forms 1099 and the accompanying Form 1096 must be filed with the Social Security Administration no later than February 28.

-

Grant reports will be prepared and submitted as required by the grantor.

Files

Hard copy files will be maintained for all supporting documents. These files will be maintained by fiscal year.

-

All donor records are filed alphabetically by donor. (presently – if someone makes an online contribution – it is not in a hard file anywhere but remains in cyberspace – also if someone mails in a check – it is copied for deposit, but their letter gets filed (we should have the email account of info@fairbanksyouthadvocates be downloaded to a computer, so we have an archive source of this that is outside the cloud, just in case. We can set this up on any office computer)

-

All paid vendor invoices are filed alphabetically by vendor.

-

All payroll transactions are filed alphabetically by employee. Employees that receive non payroll payments (i.e. travel, per diem, or reimbursements) will also have a vendor file and will be set up as a vendor in QuickBooks.

-

A separate file or binder will be set up for each grant. The grant files are maintained by the grant period regardless of the FYA’s fiscal year. A copy of all grant transactions (checks with supporting invoices, time cards, etc.) will be filed with the related grant. The original supporting documents will be filed in FYA’s regular vendor or employee file as appropriate.

Annual Operating Budget

An annual operating budget is required to be adopted by the board of directors prior to the beginning of FYA’s fiscal year. The budget should not allow expenditures in excess of funds that are conservatively projected to be received in that fiscal year.

Nice job everyone. Seems like these are all necessary. I really appreciate

all the hard work going on for FYA.